Holy Cross School is dependent upon the generosity of its donors to provide those extras that ensure the quality of virtually every aspect of school life. We are sincerely grateful for your support. Your tax-deductible charitable gift will benefit each student and allow our community to grow and advance the educational experience.

*Donation site secure

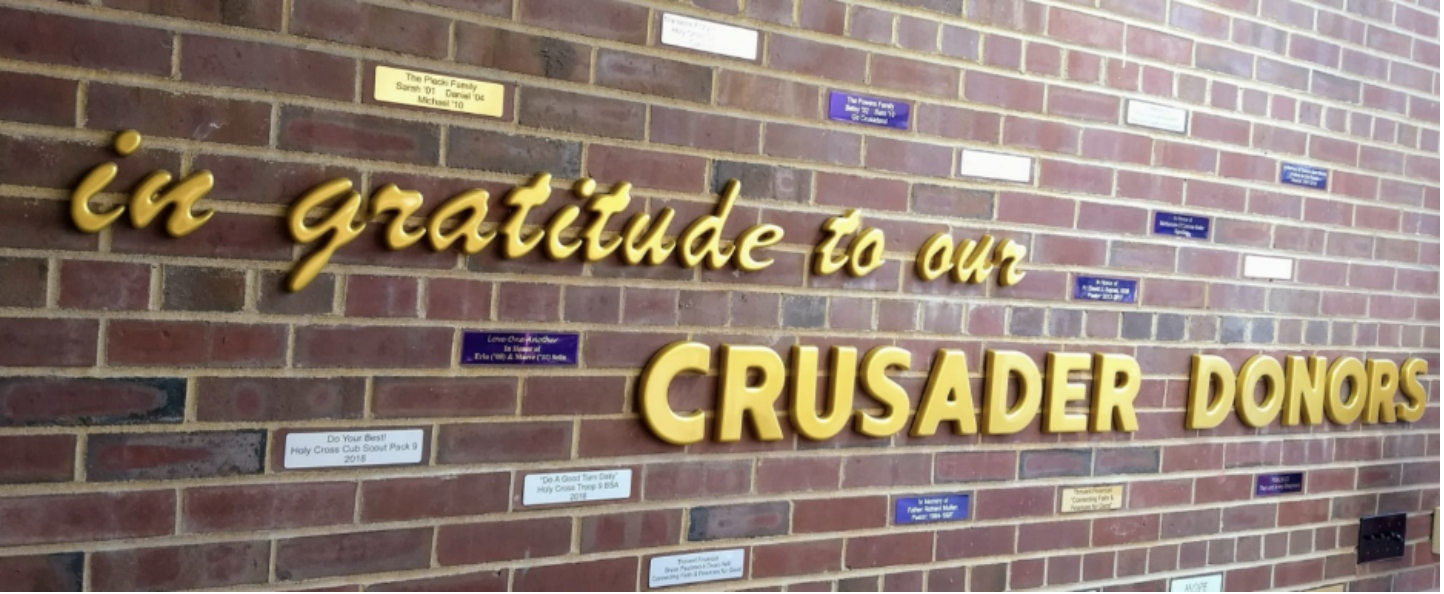

Crusader Gratitude Wall

Honor someone on our gratitude wall. Participants may honor or memorialize a beloved teacher, coach, priest, or someone who made an impact upon their life. Donors can have a family name, a favorite quote or scripture passage, or list alumni family members and the years they graduated. Silver placards are for gifts over $1,000, gold are for gifts over $5,000, and purple brass placards are for gifts over $10,000. Contact our development director at stephanie@holycrosscatholic.org for more information.

Charitable Giving Through Estates & Investments

- If you are 70.5 years or older, you can gift your Required Minimum Distribution (RMD) from your IRA. Holy Cross is a qualified charitable organization and can be selected to receive this distribution as a gift. In turn, you avoid being taxed on this withdrawal from your IRA.

- Remember Holy Cross in your estate: Use this wording in your estate plan: "I give, bequest and devise _____% of my Estate or $_____ to Holy Cross Grade School. (Contact us for Tax Exempt number.)

- Earn funds for Holy Cross through Thrivent Action Teams or Thrivent Choice Dollars. Visit www.thrivent.com for more information.

- Does your employer have a matching gift program? A matching gift is a charitable donation by a corporation that matches an employee's donation to an eligible nonprofit organization, most often dollar for dollar.

Contact our development director at stephanie@holycrosscatholic.org for assistance or more information on any of these options.

Empower Illinois Invest in Kids Tax Credit

Donate towards scholarship funds and receive a significant IL State tax credit by signing up for an Invest in Kids Tax Credit Scholarship. Illinois taxpayers can earn state tax credit for 75% of the value of their donation. Example: If the taxpayer makes a donation of $1,000, he or she can claim $750 in IL tax credit.

To find more detailed information about this process, click on Learn More. On the same page, you can watch a short “How to Donate Tutorial” video. Choose Region 4, Empower Illinois as the Scholarship Grant Organization and Holy Cross School. Tax credit reservations are given on a first come, first serve basis.